Will Rare Earth Become Rarer Still?

They can store far more energy than conventional magnets, enabling parts, devices or equipment to be miniaturized in response to recent and emerging market trends, such as smartphones and electric and hybrid cars. "

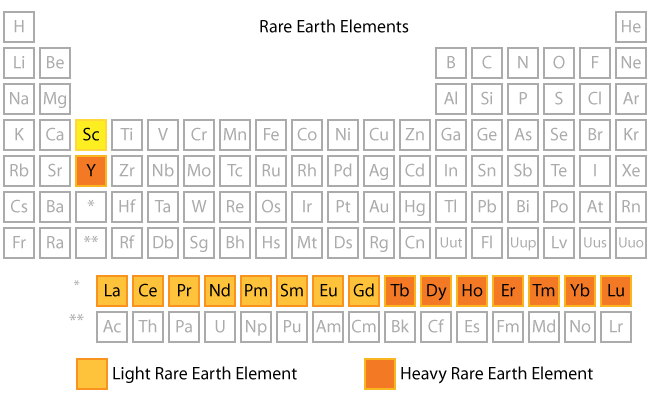

Rare earth magnets are utilized where high levels of magnetic force or energy are required. The two most used rare earth alloys are neodymium (NdFeB) and samarium cobalt (SmCo).

- NdFeB – High coercivity (high resistance to being demagnetized). NdFeB also has a high saturation magnetization giving the ability for storing large amounts of magnetic energy.

- SmCo – Samarium cobalt is often used in micro motor applications such as camera motors. Cobalt is one of the “rarer” rare earth elements, its price fluctuates dramatically resulting in the variance of the cost of the end magnet.

Additional benefits of rare earth magnets are that they reach magnetic energies well above hard ferrites and Alnico, and they permit a much smaller magnet to be used to create a like force.

Processing, however, is problematic. Not only with the heat required, but turning the ore into usable metals creates 2,000 tons of toxic waste for each ton of rare earth metals. The world’s largest rare earth operation, in Baotou, China, pours this waste into a man-made ‘sludge lake.’

Once the world leader, the US no longer mines rare earth metals. The country’s main source, the Mountain Pass Mine, closed in 1998 after a series of toxic spills released 600,000 gallons of radioactive fluid into the Mojave Desert. At the same time, China was on an all-out push to dominate the market.

China accounted for over 90% of global rare earth production and supply in the past decade, according to a report by the US Geological Survey. They are the largest exporter to the US accounting for nearly 60% of the $234mn imported to America in 2017.

Reducing dependence on China does not involve a single product or resource. It’s a whole ecosystem of supply, production, and workers. To move elsewhere you would have to replicate that entire ecosystem.

In addition, The Trump administration has ramped up the trade fight with China, by threatening to impose tariffs on an additional $200bn in Chinese goods.

China has threatened to match them dollar for dollar. This include rare earths. A trade war risks putting those minerals in the middle of the conflict, potentially giving China a way to retaliate by cutting off supplies to American companies, depriving many manufacturers of the minerals they need.

Ultimately, companies with critical metals assets that can develop the deep-pocketed partnerships necessary to advance those projects will command a premium in the months and years ahead.